The All-In-One Platform

for

.

Global Payments

Crypto Operations

Digital Banking

Financial Services

Manage international transfers, currency exchange, and compliance in one secure system.

Our Services

CNY

CNY EUR

EUR AUD

AUD CHF

CHF CAD

CAD GBP

GBP USD

USD TRY

TRY

Crypto

Crypto

Fiat

Fiat

AED

AED SGD

SGD BRL

BRL CAD

CAD EUR

EUR HKD

HKD ZAR

ZAR JPY

JPY

Our Partners

A dedicated relationship manager assigned to each account

Real-time operational support and regulatory consultancy

Customized financial strategy for international scale

Powered by

Powered by

Powered by

Powered by

Crypto Services

Integrated with TOP CEXs, DEXs, and Liquidity Providers

Seamless settlements in USDC/EURC and other regulated stablecoins

Access to 70+ supported tokens

Finance Platform

Stay ahead with cutting-edge financial solutions designed to keep you leading the way.

Additional Features

Teammates accounts let each team member log in and access only the specific pages assigned to them.

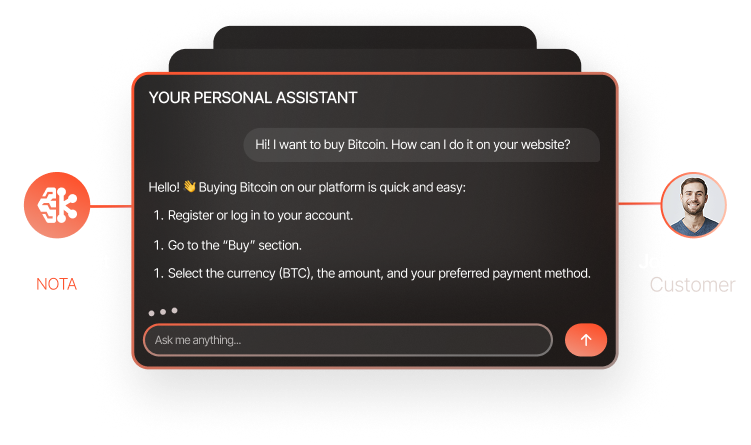

A dedicated team of expert managers providing instant assistance with any legal or regulatory questions, supported by AI-powered insights.

Continuous access to account and transaction management

Instant delivery backed by cutting-edge technology

Full visibility with detailed reports on every transaction

High-quality service backed by banking-grade security

Founder & Chief Business Development Officer Co-Founder and Chief Executive Officer

Rodion`s linkedin

Rodion`s linkedin

Stan`s linkedin

Stan`s linkedin

With fintech specialization (Harvard University) National Mining University (Ukraine, Dnipro)

In international trade and business development In business and finance

In negotiation and global partnership building Fintech strategy and global payments

Questions, meet answers

Nota is a premium financial service provider offering personalized private banking experiences for high net worth entities. We specialize in managing the full cycle of payment services, from collection to advanced currency management, ensuring a seamless, secure, and highly personalized experience.

No. Our scalable infrastructure is designed to handle transactions of any volume, from startups processing occasional payments to enterprises managing millions of transactions daily.

Most businesses achieve basic integration within 1-2 weeks. Our comprehensive APIs and developer documentation streamline the process, and our integration team provides dedicated support throughout.

Absolutely. Our platform offers extensive customization options for checkout flows, payment methods displayed, branding elements, and localization preferences.

We provide optimized currency conversion rates, support for 135+ currencies, and automatic compliance with regional payment regulations to ensure smooth cross-border transactions.

Yes. Our Access Management feature allows you to create unlimited sub-accounts with customizable permissions, enabling segmented reporting and controlled access across your organization.

We implement bank-grade encryption, tokenization, multi-factor authentication, and continuous fraud monitoring. Our platform maintains PCI DSS Level 1 compliance and follows the highest security standards.

Our Compliance Assistant provides both automated guidance and expert support to navigate regional regulations. The platform automatically adapts to compliance requirements based on transaction geography.

Yes. Our platform automatically handles Strong Customer Authentication requirements, exemption management, and other regional compliance needs for recurring transactions.

Book a Call with our experts

We look forward to exploring how we can support your needs.

NOTA INC. – MSB License M23079093

Main office: 406-1110 Finch Avenue West, North York, Ontario, M3J 2T2

Office: 1400 10 avenue SW, Calgary, AB, T3C 3Y6

Tel.: +1 825 288 1651

NOTA Sp. z o.o. – License MIP239/2024

REGON: 525637774

Office: 00-514 WARSAW, ŻURAWIA 47/49 apt. 118

Tel.: +48 880 430 314

NOTA LLC, CA – MSB 31000302240680

Office: 5307 Marconi Ave Apt 22, Carmichael, CA 95608, USA

Tel.: +1 (916) 460-0977